27

APR 2020

Preparing for Loss of Business Claims following COVID-19

Posted by Adela Botello | Business DamagesThe rise of COVID-19, followed by national stay-at-home orders, has caused many employers to temporarily close, furlough or completely lay off employees, and perhaps unfortunately, close their doors completely. Businesses, no matter how small or large, are feeling the effects. And so is their bottom line. In the coming years, employment attorneys may see an increase in the number of businesses seeking claims for business interruption insurance. When such cases arise, it is crucial to get the correct documents from the business in order to determine exactly how much revenue was lost.

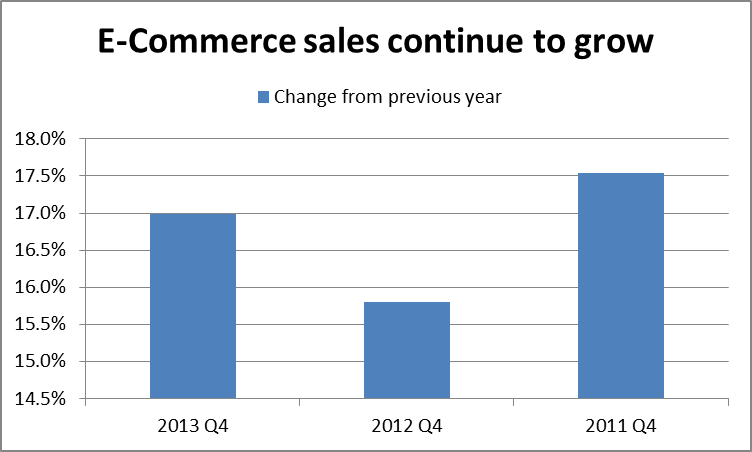

As a general rule when valuing the lost profits of a business, it is important to get as much detailed information as possible for the past three to five years. Tax records for the business will provide general information about the businesses success and overall projections for the future. Profits and losses from past years of the business will allow economists to determine the trajectory of the business prior to the interruption. If a business was declining in profits or had negative profits prior to the interruption, it is unlikely the business would have stayed afloat even if the interruption had not occurred. On the other hand, a business could have been experiencing steady increases in profits or had plans to expand that were abruptly halted. Understanding the overall state of the business is important to value potential losses.

In addition, weekly revenue and expense records will provide a much clearer picture of the state of the business pre- and post-disruption. With a restaurant for example, it would be important to know each week what the typical sales were from food and alcohol separately, as well as the typical expenses associated with items like food purchasing, staff, and electricity prior to any disruption. Detailed records prior to the disruption will then be able to be compared to current and future revenue and expenses to determine what the business has lost.

Keep in mind, the type of information that will be available for each type of business will be different, as will the metrics of success. However, this information above will give an economist the relevant background to assess any damages to the business.

In business and commercial litigation, it is frequently alleged that the offending party’s actions resulted in a lost of business profit for the other party. In some instances, the issue is that the offending party’s actions prevented the pursuit of a given business opportunity as opposed to the reduction of profits or revenue from existing business. In other words, because of the offending party’s actions the business revenue and associated profit, simply did not happen.

In business and commercial litigation, it is frequently alleged that the offending party’s actions resulted in a lost of business profit for the other party. In some instances, the issue is that the offending party’s actions prevented the pursuit of a given business opportunity as opposed to the reduction of profits or revenue from existing business. In other words, because of the offending party’s actions the business revenue and associated profit, simply did not happen.

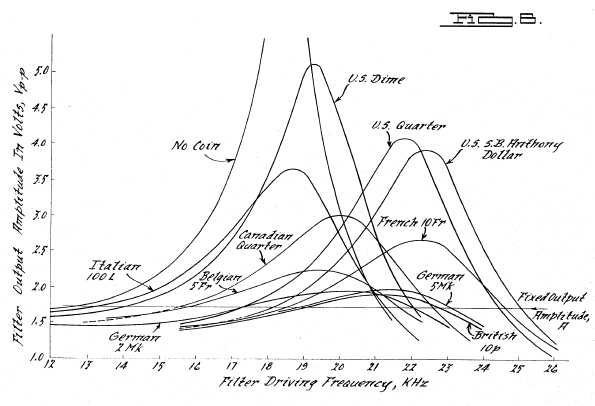

Here is the situation. Two divorcing individuals are disputing the value of a company that the two built. After, reviewing the books, one of the parties argues that the other party’s books does not reflect the value of a patent for a medical product they the two individuals developed and held.

Here is the situation. Two divorcing individuals are disputing the value of a company that the two built. After, reviewing the books, one of the parties argues that the other party’s books does not reflect the value of a patent for a medical product they the two individuals developed and held.