Some wage and business data is electronic but is not analyzable in the format that it is maintained by the employer or company.

Some wage and business data is electronic but is not analyzable in the format that it is maintained by the employer or company.

For instance,some employers use computerized data systems for recording the start times, lunch periods, and end periods for certain employees. When reviewing this data in the regular course of business some of these employers review standardized, pre-formatted reports of the time punch data instead of the actual underlying time punches that were made by each individual employee. Many of these standardized reports are presented in a PDF or other non-analyzable electronic format.

Similarly, some businesses retain certain information, such as itemized copies of purchase orders, only in a PDF or other non-analyzable electronic format.

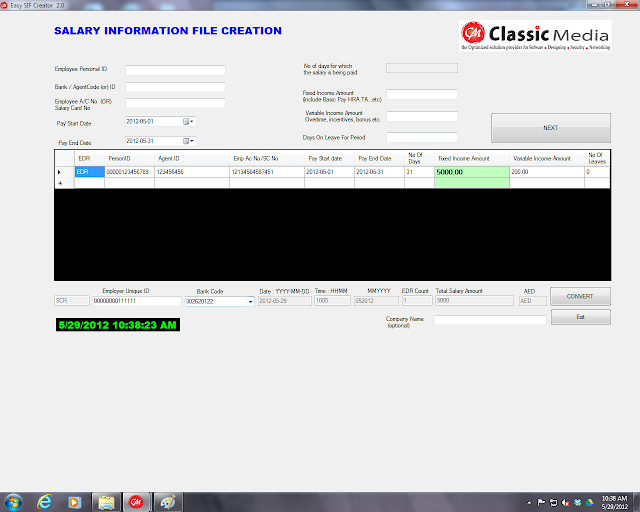

The task when addressing economic damage issues that rely on this type of non-analyzable electronic information, is to accurately and efficiently translate the data into a format that can analyzed using statistical programs, such as STATA. In cases with relatively small amounts of data spreadsheet programs such as EXCEL could also be used.

How is this done? Next>>>>

Lost profits arising from the injury of a principal employee or owner require an analysis of the actual and ‘but-for’ revenue of the business entity. The date(s) the alleged economic damage to the business began and end is an obvious stating point in the business damages analysis.

Lost profits arising from the injury of a principal employee or owner require an analysis of the actual and ‘but-for’ revenue of the business entity. The date(s) the alleged economic damage to the business began and end is an obvious stating point in the business damages analysis. Michael Lewis’ Flash Boys is a fast moving eye opener for those of us who do not spend our days working in and around ‘dark money’ pools and the backrooms of Wall Street banks.

Michael Lewis’ Flash Boys is a fast moving eye opener for those of us who do not spend our days working in and around ‘dark money’ pools and the backrooms of Wall Street banks.

A recent study ‘

A recent study ‘