Excerpted from: “Solar company spinoffs lure investors with dividends”, by Reuters

Long shunned by cautious investors, solar companies have hit on a new way, [known as Yield Companies or Yield Cos], to deliver returns to shareholders. that could attract new money to an industry notorious for its stock price volatility.

Yield cos… own and operate solar assets under long-term power-purchase agreements with utilities – a guarantee of stable cash flow.

SunEdison Inc is the first of a wave of companies preparing to bundle up existing solar power plants and then spin them off into separate entities, known as “yield cos”, to raise money to build new plants.

The promise of regular dividend payouts, hitherto unknown in the solar industry, offers an entry point to the sector for retail investors and is expected to generate huge demand when these companies go public, analysts and investors said.

Most of this cash will be paid out as dividends, with the remainder re-invested in new plants, a valuable source of funding for parent companies that will retain a sizeable stake in the new entities.

The only U.S.-listed yield co that currently holds solar assets is power company NRG Energy Inc’s NRG Yield Inc , which made its stock market debut last July [2013].

The stock for NRG increased from about $30 at its offering to over $50 on July 7, 2014.

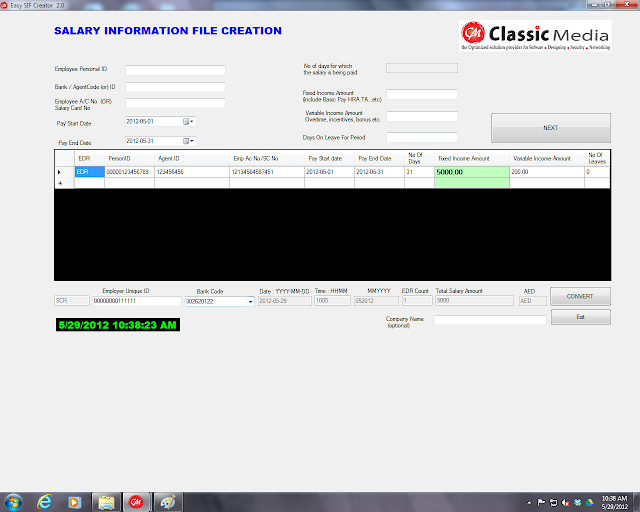

When manual data entry of non-analyzable financial or wage data is not an option, OCR software and specialized designed and written computer software data cleaning routines is a good alternative.

When manual data entry of non-analyzable financial or wage data is not an option, OCR software and specialized designed and written computer software data cleaning routines is a good alternative. Some wage and business data is electronic but is not analyzable in the format that it is maintained by the employer or company.

Some wage and business data is electronic but is not analyzable in the format that it is maintained by the employer or company.