FLSA, and what is actually required under it, are frequently misstated. While clearly some of FLSA requires a law degree to understand, the basic truths of the law can be obtained straight from the FAQ at the Department of Labor (DOL). So here are a few things that the FLSA does not provide for:

When are pay raises required?

Pay raises to amounts above the Federal minimum wage are not required by the FLSA.

Is extra pay required for weekend or night work?

The FLSA does not require extra pay for weekend or night work.

How are vacation pay, sick pay, holiday pay computed and when are they due?

The FLSA does not require payment for time not worked, such as vacations, sick leave or holidays (Federal or otherwise)

How is severance calculated and when is it due?

There is no requirement in the FLSA for severance pay.

When must breaks and meal periods be given?

The FLSA does not require breaks or meal periods be given to workers.

However, if employers do offer short breaks (lasting about five to 20 minutes), federal law considers these short breaks time for which employees must be compensated.

What must an employer provide to workers who want to express breast milk in the workplace?

Effective March 23, 2010, employers are required under the FLSA to provide unpaid break time and space for nursing mothers to express breast milk for one year after the child’s birth.

Are periodic performance evaluations required?

The FLSA does not require performance evaluations.

How many hours per day or per week can an employee work?

The FLSA does not limit the number of hours per day or per week that employees aged 16 years and older can be required to work.

How many hours is full-time employment? How many hours is part-time employment?

The FLSA does not define full-time employment or part-time employment. This is a matter generally to be determined by the employer. Whether an employee is considered full-time or part-time does not change the application of the FLSA.

When can an employee’s scheduled hours of work be changed?

The FLSA has no provisions regarding the scheduling of employees, with the exception of certain child labor provisions. T

When is double time due?

The FLSA has no requirement for double time pay.

Is extra pay required for weekend or night work?

The FLSA does not require extra pay for weekend or night work.

Are pay stubs required?

The FLSA does not require an employer to provide employees pay stubs. The FLSA does require that employers keep accurate records of hours worked and wages paid to employees.

What notices must be given before an employee is terminated or laid off?

The FLSA has no requirement for notice to an employee prior to termination or lay-off.

Overview

Overview

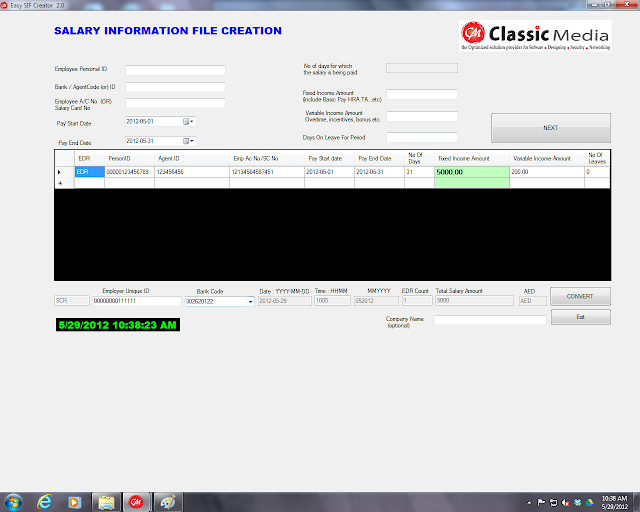

When manual data entry of non-analyzable financial or wage data is not an option, OCR software and specialized designed and written computer software data cleaning routines is a good alternative.

When manual data entry of non-analyzable financial or wage data is not an option, OCR software and specialized designed and written computer software data cleaning routines is a good alternative. Some wage and business data is electronic but is not analyzable in the format that it is maintained by the employer or company.

Some wage and business data is electronic but is not analyzable in the format that it is maintained by the employer or company. Numerous news sources reported on the wage and hour lawsuit filed by one LA Raider cheerleader against the team for allegedly violating California state wage and hour laws.

Numerous news sources reported on the wage and hour lawsuit filed by one LA Raider cheerleader against the team for allegedly violating California state wage and hour laws. If employees who are under a AWS receive few than the number of scheduled hours then a short shift has occurred. For short shifts, employees are paid overtime for hours worked in excess of 8 and double time for hours in excess of 12. From

If employees who are under a AWS receive few than the number of scheduled hours then a short shift has occurred. For short shifts, employees are paid overtime for hours worked in excess of 8 and double time for hours in excess of 12. From