Abstract (From Millimet et. al)

Measuring an individual’s human capital at a point in time as the present actuarial value of expected net lifetime earnings has a lengthy history. Calculating such measures requires accurate estimates of worklife expectancy. Here, worklife estimates for men and women in the USA categorized by educational attainment, race, marital status, parental status and current labour force status are presented. Race has a much larger impact on the worklife expectancy of men than women. Education is associated with larger worklife differentials for women. The association between marriage and worklife expectancy is significant, but of opposite sign, for men and women: married women (men) have a lower (higher) worklife expectancy than single women (men). Parenthood is associated with a reduction in the worklife expectancy of women; the association is smaller and varies from positive for some education/marital status groups to negative for others for men.

From:

DETAILED ESTIMATION OF WORKLIFE EXPECTANCY FOR THE MEASUREMENT OF HUMAN CAPITAL: ACCOUNTING FOR MARRIAGE AND CHILDREN

Daniel L. Millimet

Southern Methodist University

Michael Nieswiadomy

University of North Texas

Daniel Slottje

Southern Methodist University:

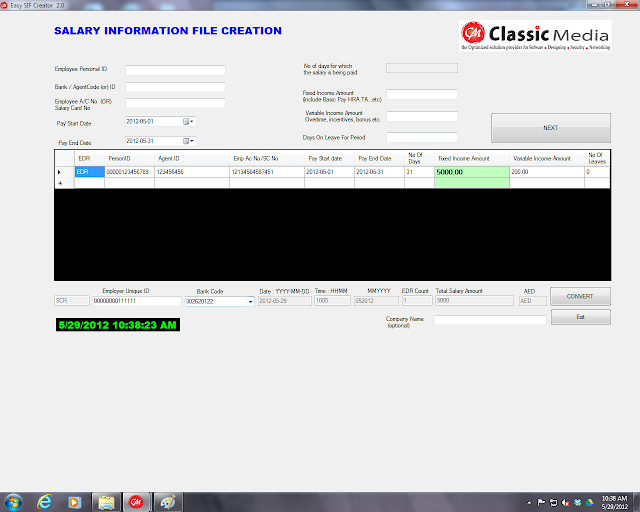

When manual data entry of non-analyzable financial or wage data is not an option, OCR software and specialized designed and written computer software data cleaning routines is a good alternative.

When manual data entry of non-analyzable financial or wage data is not an option, OCR software and specialized designed and written computer software data cleaning routines is a good alternative. Some wage and business data is electronic but is not analyzable in the format that it is maintained by the employer or company.

Some wage and business data is electronic but is not analyzable in the format that it is maintained by the employer or company.

The U.S. BLS released some interesting statistics on what people born in the early 1980’s are doing today in the labor market, school, and at home. The findings are from the National Longitudinal Survey of Youth 1997, a nationally representative survey of about 9,000 young men and women who were born during the years 1980 to 1984

The U.S. BLS released some interesting statistics on what people born in the early 1980’s are doing today in the labor market, school, and at home. The findings are from the National Longitudinal Survey of Youth 1997, a nationally representative survey of about 9,000 young men and women who were born during the years 1980 to 1984