Tag: Industry

U.S. Commerce Department data show Internet retail sales continue to grow

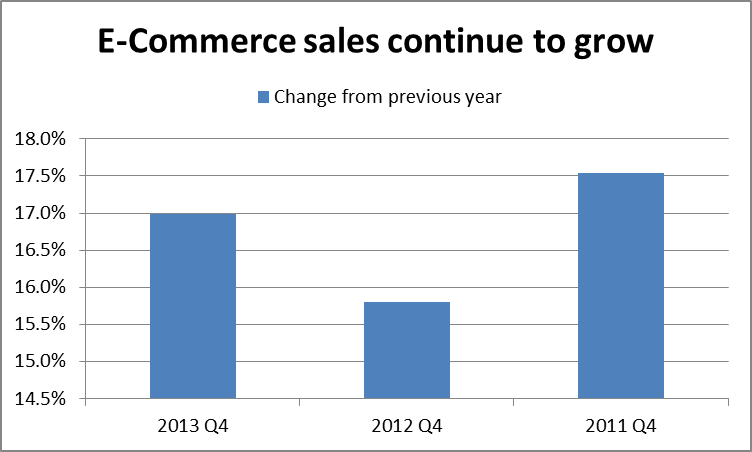

Retail sales over the internet continue to increase in the U.S.

Internet sales, or as the Commerce department puts it: sales of goods and services where an order is placed by the buyer or price and terms of sale are negotiated over an Internet, extranet, Electronic Data Interchange (EDI) network electronic mail, or other online system, have increased over 15% each year of the last three years.

E-Commerce now makes up about 6% of all retail sales in the U.S.

Source: http://www2.census.gov/retail/releases/historical/ecomm/

| Time Period | E-commerce Sales | Change from previous year |

| 2013 Q4 | 83,709 | 17.0% |

| 2012 Q4 | 71,554 | 15.8% |

| 2011 Q4 | 61,789 | 17.5% |

| 2010 Q4 | 52,567 |

.

NY Fed small business credit survey shows that small businesses are upbeat about 2014 but are concerned about lumpy cash flow streams

The New York Fed surveys over 1,500 small firms twice a year about their financing and credit needs. Responses to the Small Business Credit. (It would be nice for the other Fed banks to do a similar study, hint, hint)

In the Q4 2013 survey, a weighted to be a statistically representative sample of firms in New York, New Jersey, Connecticut, and Pennsylvania reported on their business performance and credit

experiences in the first half of 2013 and their outlook for the first half of 2014.

Here are the highlights.

- Firm outlook is positive for Q1 and Q2 2014: more than 50% expect rev. to increase and 30% expect to add employees

- Firms report small credit needs and high search costs: most sought loans <$100k; more than 26 hours spent on the search

- Managing uneven cash flow dominates firm concerns

- More experience and success correlated with more favorable credit experience

How far down do water rights go?

Some say down to the center of the earth. Other say that it is ok to drill and capture water that spills over to another’s land.

Some say down to the center of the earth. Other say that it is ok to drill and capture water that spills over to another’s land.

The Texas Supreme Court will hear arguments in Jan 2014.

From The Texas Tribune:

The Texas Supreme Court is scheduled to hear arguments on Jan. 7 in a dispute between a company that operates injection wells in Liberty County and a nearby rice farm that says wastewater from those wells has migrated into a saltwater aquifer below its land. It calls the migration trespassing, for which it should be compensated.

Wanna know how many and what types of business there are in a particular county? See the U.S. County Business Patterns data at the U.S. Census

From: The U.S. Census: County Business Patterns (CBP) is an annual series that provides subnational economic data by industry. This series includes the number of establishments, employment during the week of March 12, first quarter payroll, and annual payroll. This data is useful for studying the economic activity of small areas; analyzing economic changes over time; and as a benchmark for other statistical series, surveys, and databases between economic censuses. Businesses use the data for analyzing market potential, measuring the effectiveness of sales and advertising programs, setting sales quotas, and developing budgets. Government agencies use the data for administration and planning.

ZIP Code Business Patterns data is available shortly after the release of County Business Patterns. It provides the number of establishments by employment-size classes by detailed industry in the U.S.