Business interruption cases come in many different shapes and sizes. In some business interruption cases the allegation is that the defendants’ actions increased the operating cost of the plaintiff.

For instance and one recent business interruption case the defendant’s drill and on-going construction activity unknowingly interfered with the plaintiffs’ fiber optic lines drilling.

After the damaged lines were discovered by the plaintiff, the plaintiff spent a number of months fixing and creating new fiber optic lines. In addition to the out-of-pocket expense associated with the with the punctured fiber-optic lines, the plaintiffs also allege that they also incurred a correlated expense of having to use some of their existing employees to help mitigate the damage.

For instance, the plaintiff indicated that the mitigation of the damage caused by the defendant caused them to require substantial overtime hours from its employees to reestablish the lines and to maintain their service. The plaintiff after about eight months was able to get back up to speed and back to where there were prior to the incident.

In this case the alleged out-of-pocket expenses were relatively easy to determine. The company had to purchase more fiber optic and faced of the increased cost associated with installing those lines.

However the plaintiff also alleged that they experienced increased operating expenses, especially in terms of employee expenses.

Increased employee operating expenses is not always as straightforward to calculate. In this instance, employer did not necessarily hire more employees. Instead, the employer used their existing employees at a higher level, required overtime, and shifted employees from one job or project to another. In these types of instances the employee expenses associated with the disruption is not so clear.

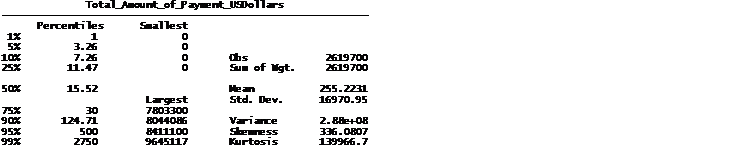

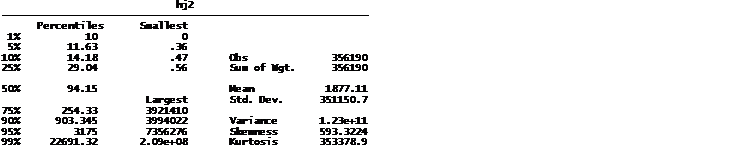

One way to determine damages in this case is to look at up is to use financial ratios. Financial ratios such as the e

mployee expense to revenue ratio determine show how the company employs its employees.

For instance, a high employee expense ratio to revenue indicates that the company uses a lot of employees relevant relative to their revenue. A company with a high expense to revenue ratio is a relatively labor intensive company. Conversely, a company with a relatively low expense to revenue ratio is a relatively less employee intensive employer or company.

In a business interruption case, one approach is to look at the changes in these ratios both before and after the incident. Changes in these ratios can indicate the impact of the alleged actions. For instance the employee expense to revenue ratio could change dramatically following the alleged incident.

Other useful financial expense ratios include the full-time employee equivalent (FTE) ratios. FTE ratios are ratios that show how many full-time employees the company typically utilizes. FTE measures take into account the part time work, overtime, and the different compensation structures that the company may utilize in its business.