A recent study by the CBO projects that access to affordable health insurance will result in over 2 million workers reducing their hours or leaving the workforce all together.

A recent study by the CBO projects that access to affordable health insurance will result in over 2 million workers reducing their hours or leaving the workforce all together.

There are four questions that come to mind when thinking about this issue.

Q1: Is the economics behind the CBO economic projection sound?

Yes, the economics behind this projection are sound. If health-insurance is a important determinant of a person’s decision to supply labor then a person that no longer has to supply as much labor to the labor market to get health insurance will no longer have as much incentive to work as hard.

That is, at every wage there will be fewer workers, all other things equal, that will be willing to work

If that is the case, then labor supply falls and the number of workers in the labor market falls and, if labor demand remains unchanged, wages rise. In addition to the number of workers falling, the amount of hours worked could also decrease if individuals were able to get affordable health care without working full-time.

So the economics of the statement and the CBO projection are sound.

Q2: Is it even possible to reduce the hours that a person works? That is don’t most people have their hours dictated to them by their employer?

Yes, it is very possible to reduce the hours that a person works. The person could choose to work part time as opposed to full time.

Most studies however would suggest that it is more likely that people would choose to not work it all. In particular lower income workers would more likely be faced with a decision of receiving subsidized, lower health care and working less or working more hours and having to pay for unsubsidized health insurance.

Q3: By how much would access to affordable healthcare reduce the number of hours worked by employees in my industry?

The answer to this question is varied. Most recent studies of labor market elasticities suggest that some workers, such as young in unmarried mothers, would be more sensitive to changes in the health law than other types of workers such as higher income professional workers.

The CBO, the authors of the most recent study, recently published a review of the latest labor market supply elasticities. Generally, the review suggest that younger and lower income unmarried women would be most likely to be impacted.

Q4: Is this reduction in work hours and labor force participation a good thing or bad thing for the economy?

This question is for the citizenry to answer! If for example the reduction in hours worked results in unmarried young mothers having more time to rear their children then society may see this as a good thing.

Alternatively, the reduction in hours work and labor force participation will at some point cause an increase in wages. Fewer people in a labor market will do that. This could be viewed as a bad for society. The true impact depends on the individual labor supply elasticities of the groups at issue and most at risk of being impacted and having to make the decision to work or not work.

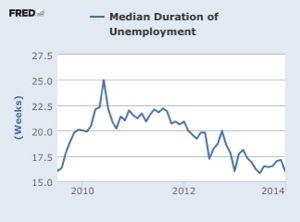

James D. Eubanks and David G. Wiczer of the St. Louis recently authored a study in the January 2014 ‘The Regional Economist’ St. Louis newsletter that looked at the impact different types of job search methods,such as networking and cold calling, have on the likelihood of obtaining employment. The study is based on straightforward tabulations of data obtained from the U.S. BLS CPS data. The authors performed multiple tabulations of the the job search type variable found in this data and then reported findings from various years and cross sections of the data.

Some employers grade their employee’s job performance on a curve. In these systems, like back in college, the employer generally sets the number of A, B,C’s etc. to assign to the employees performance. Proponents argue that the system is more fair and adds to employee moral in the long run. Neal Buethe of

Some employers grade their employee’s job performance on a curve. In these systems, like back in college, the employer generally sets the number of A, B,C’s etc. to assign to the employees performance. Proponents argue that the system is more fair and adds to employee moral in the long run. Neal Buethe of